Are You Tired Of Having To Use Spreadsheets To Assist With Calculating Payroll? Are You Sure There Is A Better Way?

WE WANT TO SHOW YOU THAT THERE IS A BETTER WAY! AFTER ALL, YOUR PAYROLL SOFTWARE AND NOT YOU SHOULD CALCULATE AND MANAGE YOUR PAYROLL, RIGHT?

FOR THOSE WHO DON’T LIKE TO WASTE TIME.

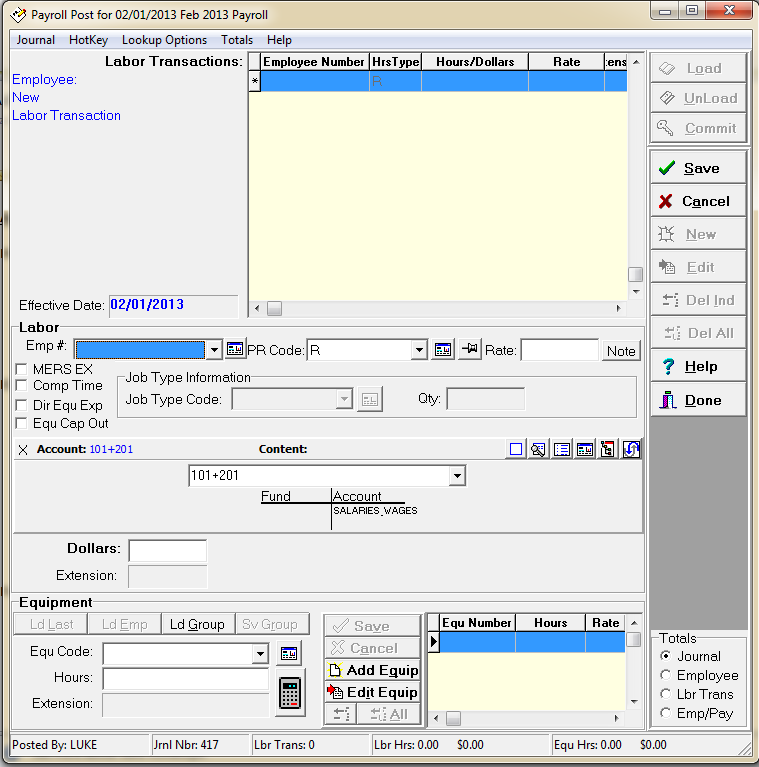

From the special employees with a host of hoops to jump through to standard employees with standard deductions, Pro Fund Accounting’s “set it and forget it” payroll capabilities give administrators incredible flexibility to tailor payroll for all sorts of employees. Gone are the days of running individual payrolls for multi-fund timecards – PFA’s system gives you complete and total flexibility in posting timecards.

All the information you need to process taxes is contained in the Payroll Constant Maintenance programs! Set up as many deduction codes, payroll banks and pay types as necessary – from Regular to Holiday to Jury Duty and more. You can even determine how they affect one another!

Pro Fund Accounting provides an extensive payroll report library, numerous check layouts, auto-signatures and quarterly tax reports. Print and sign payroll checks quickly – and accounting entries are automatically made to your general ledger. You’ll never be out of balance!

You’ll set up new pay types, account numbers and employees within the software itself – no need to shuffle through windows!

Oh, and we’re intentional about keeping all Federal and State withholding tax information up-to-date.

Any further questions? Fill out the form on this page and let’s talk.

Payroll Features

- Automatic credit entries

- Multiple account lookup routines

- Process quarterly and annual tax reports when you’re ready

- Multiple batch total views

- Multiple check layouts

- Full tax reporting

- Print or E-File year-end W2s

- Context-sensitive help with the press of a button

- Process and report on payroll by fund

- Deduction, pay, and bank histories are kept forever

- Offer employees the convenience of paycheck direct deposit